Wall Street rallied Thursday morning as July retail sales jumped 1%—triple what experts expected. Meanwhile, jobless claims dropped, and investors are still riding high on those cooler-than-expected inflation reports (CPI and PPI).

Wall Street rallied Thursday morning as July retail sales jumped 1%—triple what experts expected. Meanwhile, jobless claims dropped, and investors are still riding high on those cooler-than-expected inflation reports (CPI and PPI).

Anticipating a possible Fed rate cut, investors now think that a recession may not be on the horizon. If this means that more consumers are willing to open their wallets, then…

- Is it now time to “go long” retail?

- How does it compare to its sector (Consumer Discretionary) or the S&P 500?

- Retail is seasonal, so what does that context tell us?

Let’s look at a weekly chart of the SPDR S&P Retail ETF (XRT), an industry proxy.

XRT Macro View – Poised for a Big Move?

XRT’s short-term moves may seem stuck in neutral, but zoom out, and you’ll see a cautious, if not ambivalent, uptrend, sticking close to the rising 200-period simple moving average (SMA) that stopped XRT’s drop back in 2022. It’s not quite screaming bullish, but neither is it waving any red flags.

CHART 1. WEEKLY CHART OF XRT. You need to zoom out to see that XRT’s price actions outline a tame uptrend.

The StockChartsTechnicalRank (SCTR) tool is one way to gauge a stock’s technical strength across multiple timeframes. XRT’s SCTR performance? At 47, it’s serving up some pretty “lukewarm” vibes. But the SCTR line is rising, and the question is whether XRT is poised for a breakout or a breakdown. Fortunately, you can be prepared for either scenario if you analyze the daily chart.

CHART 2. DAILY CHART OF XRT. That’s a wide rectangle.

Thursday’s gap opening may seem like an isolated event, but in the context of the wide trading range, a wide rectangle pattern spanning $70 to $80, its impact looks muted. Also, note that, according to the Chaikin Money Flow (CMF), there’s hardly any momentum backing the near-term spike, as selling pressure (see red box) has prevailed since April.

XRT’s relative performance against the S&P 500 is -6%, meaning there’s room for improvement, but only if economic conditions are conducive to retail’s rise.

XRT – Levels to Watch

- For XRT’s longer-term uptrend to resume, it has to break above resistance at the $79 or, to be safe, the $80 level.

- For this breakout to hold, the CMF must stay above zero, signaling that buying pressure has officially taken the lead over selling pressure.

- If XRT breaks below the bottom of the rectangle formation at $70, then look for support near $67, which marks the 2024 swing low and the July 2023 swing high.

- If XRT drops below $67, that’s your cue to watch out for more downside. Time to hit pause and re-evaluate the fundamentals before planning your next move.

What Does XRT’s Seasonality Look Like?

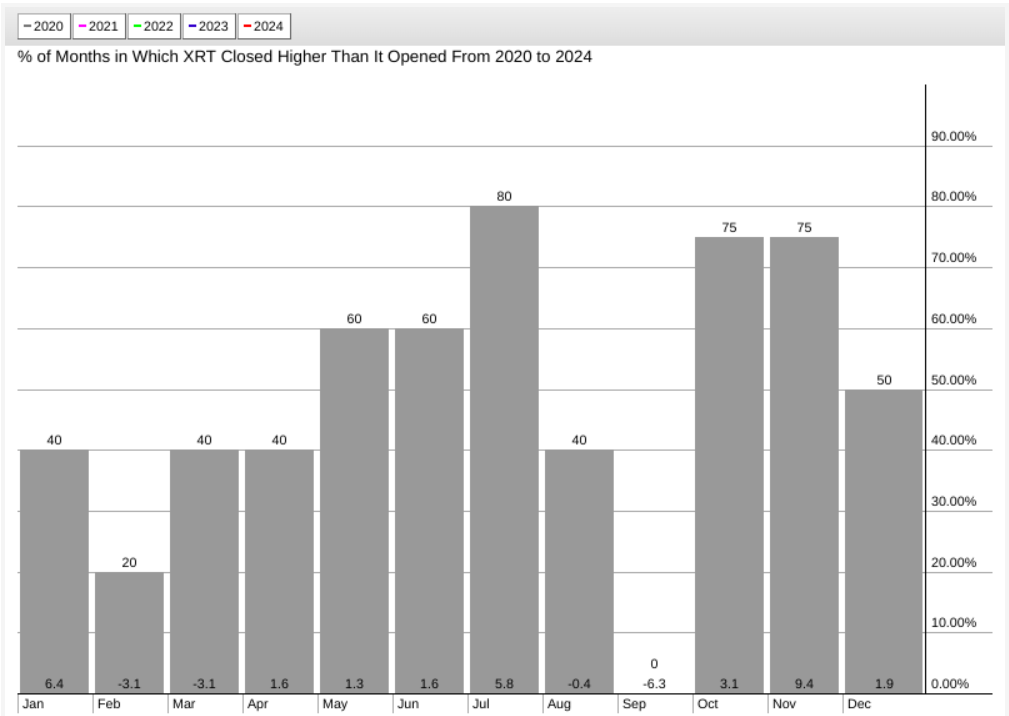

CHART 3. FIVE-YEAR SEASONALITY CHART OF XRT. Note September’s negative higher-close rate.

I’m capping this seasonality chart at five years to add more weight to the inflationary pressures that significantly affect the discretionary segment of the retail industry. As you can see, there’s an almost-shocking zero higher close rate in September (numbers above the bar, but in September, there’s no bar). It also happens to be XRT’s worst performance, with a relative return of -6.3%.

Yet despite inflation, XRT has shown outstanding performance in October and November with a 75% higher-close rate each month and a respective return of 3.1% and 9.4% (November being its strongest seasonal month in the last five years).

At the Close

So, if XRT’s seasonality profile holds true for September, will XRT dip below the current rectangle formation, or will it rise in the next few months to outperform in October and November? Either way, you’ve got the key levels to keep an eye on moving forward.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.